UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| | |

☐☑ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☑☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to § 240.14a-12 |

ENVISTA HOLDINGS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | | | | |

| ☑ | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

20222024

Notice of Annual Meeting

of Stockholders

and Proxy Statement

ENVISTA HOLDINGS CORPORATION

200 S. Kraemer Boulevard, Building E

Brea, CA 92821

Notice of 20222024 Annual Meeting of Stockholders

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | |

| ¶ | 3 | ? | : |

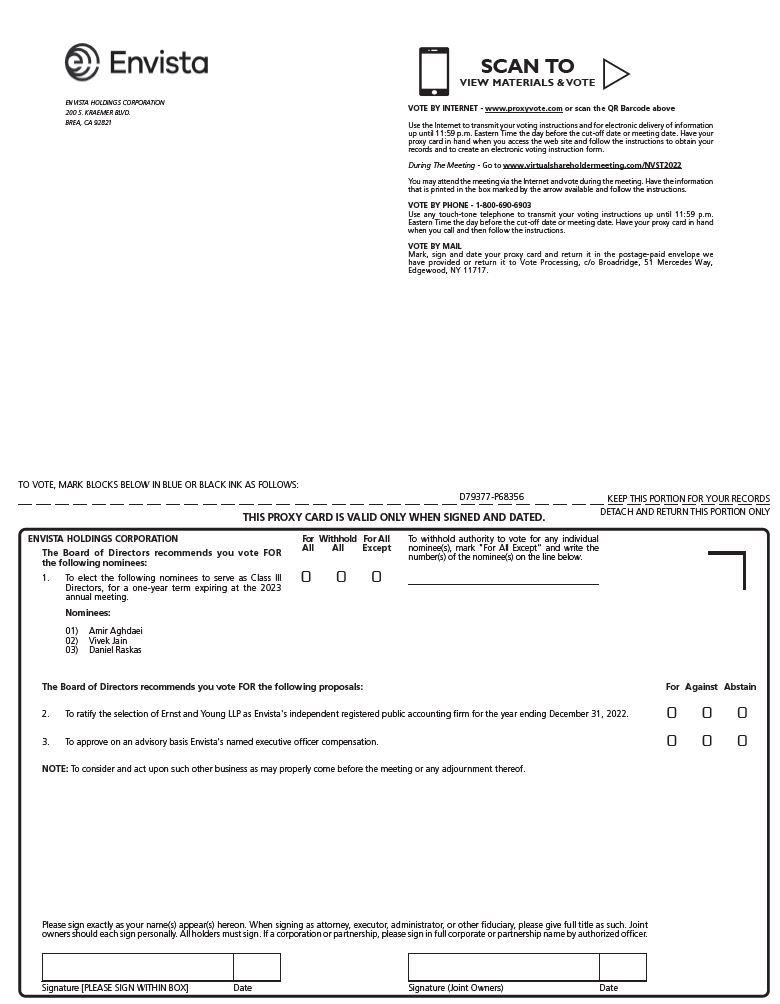

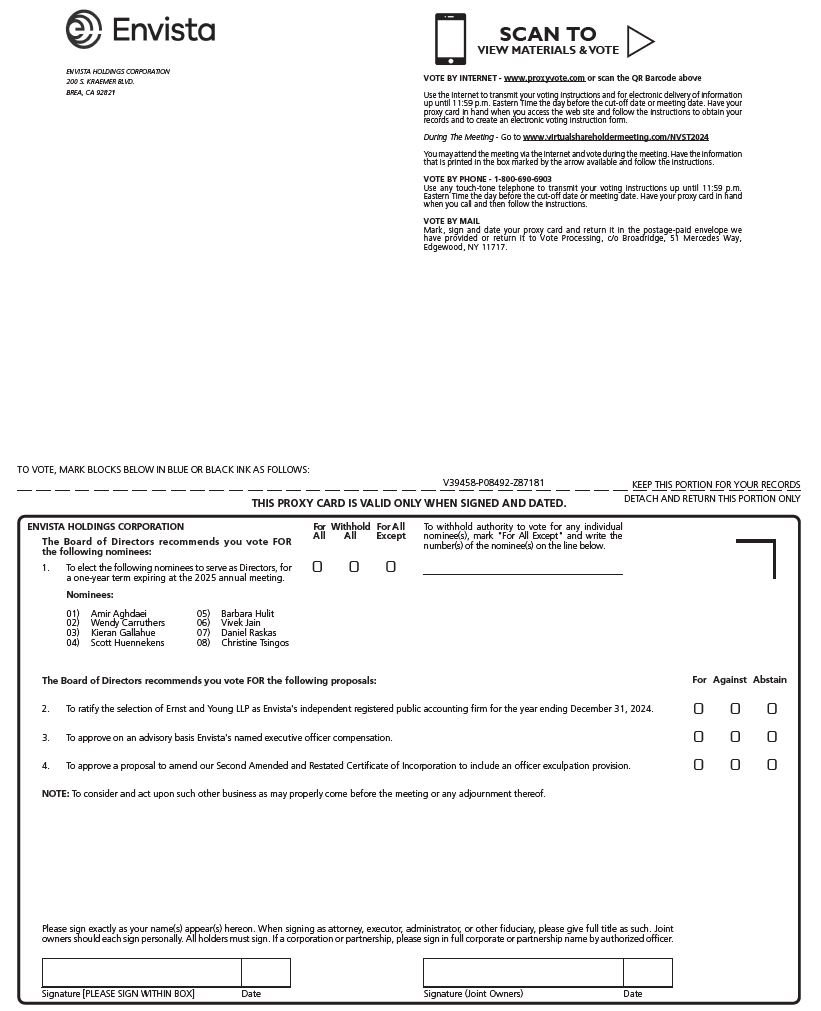

When: May 24, 202221, 2024 at 7:0030 a.m., PT. Where: Virtually, at www.virtualshareholdermeeting.com/NVST2022NVST2024

| | Items of Business: 34 measures to

review as listed below | | Who Can Vote: Stockholders of Envista’s common stock at the close of business on March 30, 2022.25, 2024. | | Attending the Meeting: Stockholders will be able to attend, vote and submit questions during the Annual Meeting from any location via the Internet.* Date of Mailing: The date of mailing of this Proxy Statement or Notice of Internet Availability is on or about April 13, 2022.[ ], 2024. |

*The 20222024 Annual Meeting will be a virtual meeting conducted solely online and can be attended by visiting www.virtualshareholdermeeting.com/NVST2022. A list of stockholders entitled to vote at the 2022 Annual Meeting will be accessible to stockholders during the meeting on the meeting website.NVST2024.

Items of Business:

1. To elect the eight director nominees named in the Proxy Statement, each of Mr. Amir Aghdaei, Mr. Vivek Jain, and Mr. Daniel Raskas to serve as a Class III Director, for a one-year term expiring at the 20232025 annual meeting of stockholders and until his successor istheir successors are elected and qualified.

2. To ratify the selection of Ernst & Young LLP as Envista’s independent registered public accounting firm for the year ending December 31, 2022.2024.

3. To approve on an advisory basis Envista’s named executive officer compensation.

4. To approve a proposal to amend our Second Amended and Restated Certificate of Incorporation to include an officer exculpation provision.

5. To consider and act upon such other business as may properly come before the meeting or any adjournment thereof.

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

Most stockholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card or voting instruction form. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 24, 2022:21, 2024:

The Notice of Internet Availability, Notice of Annual Meeting, Proxy Statement and the Annual Report are available at: http://www.proxyvote.com.

| | | | | |

| By Order of the Board of Directors, |

| Mark Nance |

| Secretary |

April 13, 2022[ ], 2024

20222024 Annual Meeting of Stockholders

Notice of Annual Meeting and Proxy Statement

Table of Contents

| | | | | |

| Proxy Statement Summary | |

| |

| Proxy Statement | |

| |

| Purpose of the Annual Meeting | |

| |

| Annual Meeting Admission | |

| |

| Outstanding Stock and Voting Rights | |

| |

| Solicitation of Proxies | |

| |

| Proxy Instructions | |

| |

| Notice of Internet Availability of Proxy Materials | |

| |

| Voting Requirements With Respect to Each of the Proposals Described in this Proxy Statement | |

| |

| Voting Methods | |

| |

| Changing Your Vote | |

| |

| Householding | |

| |

| Beneficial Ownership of Common Stock by Directors, Officers and Principal Stockholders | |

| |

| Directors and Executive Officers | |

| |

| Principal Stockholders | |

| |

| Proposal 1 – Election of Directors | |

| |

DeclassificationElection of the BoardDirectors | |

| |

Election of DirectorsDirector Nominees | |

| |

Class III Director Nominees | |

| |

Current Class I Directors | |

| |

Current Class II Directors | |

| | | | | |

| Board Composition and Diversity | |

| |

| Corporate Governance | |

| |

| Corporate Governance Overview | |

| |

| Corporate Governance Guidelines, Committee Charters and Code of Conduct | |

| |

| Board Leadership Structure | |

| |

| Risk Oversight | |

| |

| Director Independence | |

| |

| Board of Directors and Committees of the Board | |

| |

| Director Nomination Process | |

| |

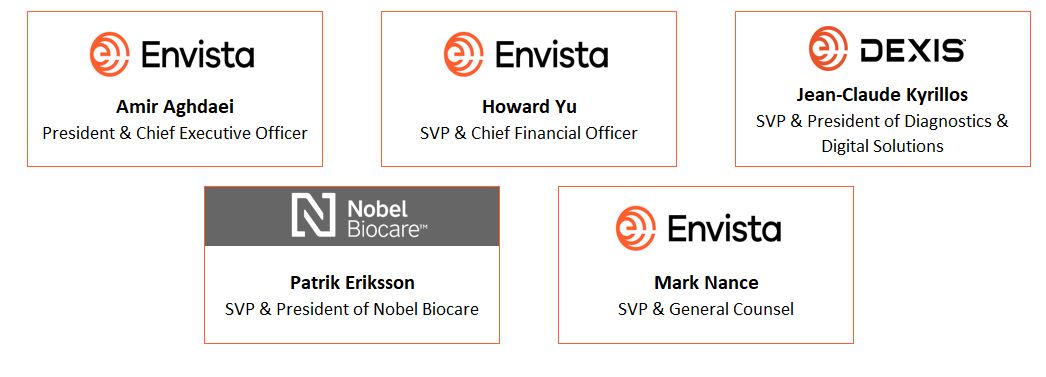

| Executive Officers of the Company | |

| |

| Certain Relationships and Related Transactions | |

| |

| Policy | |

| |

| Relationships and Transactions | |

| |

| |

| |

| |

| |

| |

| | | | | |

| Compensation Discussion and Analysis | |

| |

| Executive Summary | |

| |

20212023 Executive Compensation Decision-Making and Oversight | |

| |

Analysis of 20212023 Executive Compensation | |

| |

20222024 Executive Compensation Developments | |

| |

| Compensation Peer Group Analysis | |

| |

| Stock Ownership Policies | |

| |

| Recoupment Policy | |

| |

| Tax Deductibility of Executive Compensation | |

| |

| Risk Considerations and Review of Executive Compensation Practices | |

| |

CEO Pay RatioCompensation Committee Report | |

| |

| | | | | |

Executive Compensation Committee ReportTables | |

| |

ExecutiveSummary Compensation TablesTable | |

| |

Summary Compensation Table | |

| |

Grants of Plan-Based Awards for Fiscal 20212023 | |

| |

Outstanding Equity Awards at 20212023 Fiscal Year-End | |

| |

Option Exercises and Stock Vested During Fiscal 20212023 | |

| |

20212023 Nonqualified Deferred Compensation | |

| |

Potential Payments Upon Termination or Change-of-Control as of 20212023 Fiscal Year-End | |

| |

Employment Agreements with our NEOs | |

| |

| Employee Benefit Plans | |

| |

| CEO Pay Ratio | |

| |

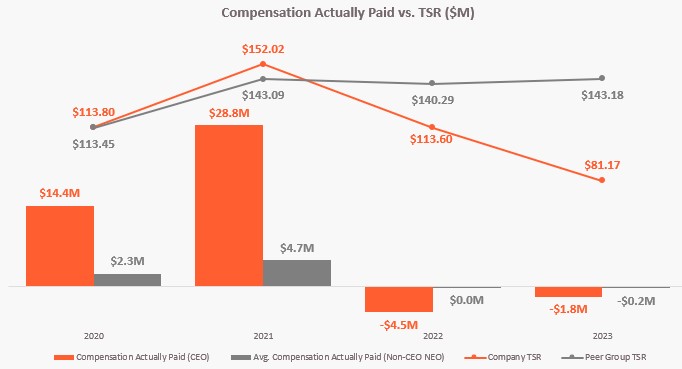

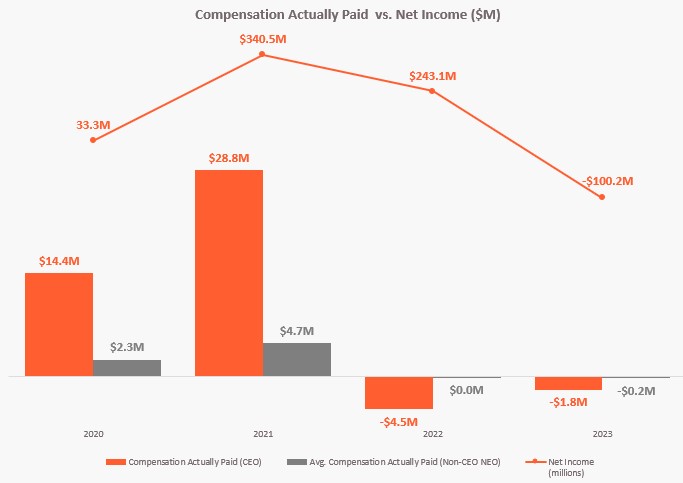

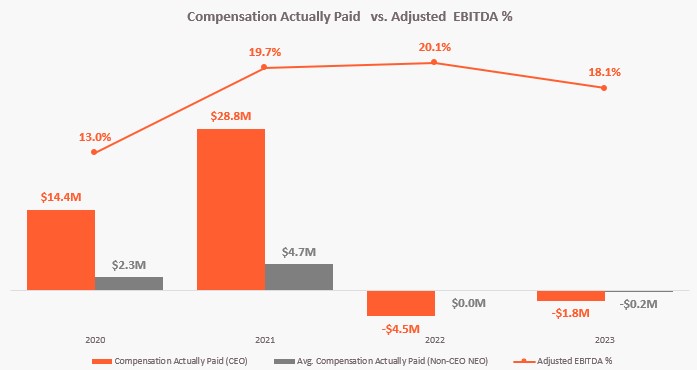

| Pay Versus Performance | |

| |

| Equity Compensation Plan Information | |

| |

| Director Compensation | |

| |

| Director Compensation Philosophy | |

| |

| Process for Setting Director Compensation | |

| |

| Director Compensation Structure | |

| |

Changes to Director Compensation | |

| |

| Director Stock Ownership Requirements and Hedging / Pledging Policy | |

| |

| Director Summary Compensation Table | |

| |

| Proposal 2 – Ratification of Independent Registered Public Accounting Firm | |

| |

| Fees Paid to Independent Registered Public Accounting Firm | |

| |

| Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors | |

| |

| Audit Committee Report | |

| | | | | |

| Proposal 3 – Advisory Vote on Executive Compensation | |

| |

Other MattersProposal 4 – Approval of an Amendment to Our Second Amended and Restated Certificate of Incorporation to Include an Officer Exculpation Provision | |

| |

Website DisclosureDelinquent Section 16(a) Reports | |

| |

| Other Matters | |

| |

| Website Disclosure | |

| |

| Stockholder Proposals for Next Year’s Annual Meeting | |

| |

| Appendix A - Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited) | |

| |

| Appendix B - Certificate of Amendment to the Second Amended and Restated Certificate of Incorporation of Envista Holdings Corporation | |

Proxy Statement Summary

To assist you in reviewing the proposals to be acted upon at our 20222024 Annual Meeting, below is summary information regarding the meeting. For more information about these topics, please review the complete Proxy Statement. This Proxy Statement and proxy card are first being sent to our stockholders on or about April 13, 2022.[ ], 2024.

20222024 Annual Meeting of Stockholders

| | | | | | | | |

| Date and time: | | May 24, 2022,21, 2024, 7:0030 a.m. PT |

| Place: | | Virtually, at www.virtualshareholdermeeting.com/NVST2022NVST2024 |

| Record date: | | March 30, 202225, 2024 |

| Voting: | | Stockholders of Envista’s common stock at the close of business on March 30, 202225, 2024 are entitled to one vote per share of common stock on each matter to be voted upon at the 20222024 Annual Meeting of Stockholders (“Annual Meeting”). |

| Admission: | | To virtually attend the Annual Meeting, you will need the control number located on the Notice of Internet Availability of Proxy Materials, your proxy card or the instructions that accompanied your proxy materials. |

Items of Business

| | | | | | | | | | | | | | |

| PROPOSAL | | VOTE REQUIRED | | BOARD

RECOMMENDATION |

Proposal 1: Election of Class III Directors (page 1413) | | Plurality of votes cast for each of the director nominees. | | FOR each of the nominees |

| | | | |

Proposal 2: Ratification of the appointment of the independent registered public accounting firm (page 6063) | | The affirmative vote of a majority of the shares represented in person (virtually) or by proxy. | | FOR |

Proposal 3: Approval on an advisory basis of our named executive officer compensation (page 6265) | | The affirmative vote of a majority of the shares represented in person (virtually) or by proxy. | | FOR |

Proposal 4: Approval of an Amendment to our Second Amended and Restated Certificate of Incorporation to include an officer exculpation provision. (page 66) | | The affirmative vote of a majority of the outstanding shares entitled to vote at the Annual Meeting. | | FOR |

Company Overview

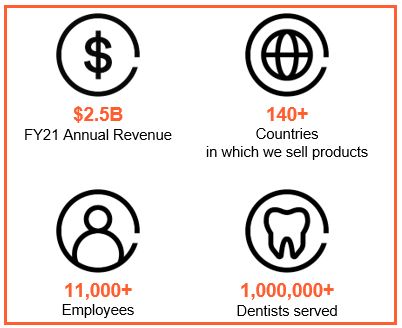

Envista is a global family of more than 30 trusted dental brands, including Nobel Biocare, Ormco, DEXIS and Kerr, united by a shared purpose: to partner with professionals to improve lives.lives by digitizing, personalizing and democratizing oral care. We help our customers deliver the best possible patient care through industry-leading dental consumables, solutions, technology,technologies, and services. Our comprehensivediversified portfolio including dental implants and treatment options, orthodontics, and digital imaging technologies,of solutions covers a broad range of dentists' clinical needs for diagnosing, treating, and preventing dental conditions as well as improving the aesthetics of the human smile. We offer comprehensive solutions to support implant-based tooth replacements, orthodontic treatments, and diagnostic solutions. We further support the dental community with leading solutions in restoratives, endodontics, rotary, infection prevention and loupes.

With a foundation comprised of the proven Envista Business System (“EBS”) methodology, an experienced leadership team, and a strong culture grounded in continuous improvement, commitment to innovation, and deep customer focus, we are well equipped to meet the end-to-end needs of dental professionals worldwide. We are one of the largest global dental products companies, with significant market positions in some of the most attractive segments of the dental products industry. We serve more than a million dentistsdental professionals in over 140130 countries through one of the largest commercial organizations in the dental products industry and through our dealer partners. In 2021,2023, we generated total sales of $2.5$2.6 billion, of which approximately 82%85% were derived from sales of consumables, services and spare parts.

On September 20, 2019, we completed our initial public offering and separated from Danaher Corporation (the “Separation”). The disposition of our shares owned by Danaher (the “Split-Off”) was completed on December 18, 2019 and resulted in the full separation of us and disposal of Danaher’s entire ownership and voting interest in us.

Financial Highlights

| | | | | | | | |

| $ in millions - except per share amounts | 2021 | 2020 |

| Total Revenue | $2,508.9 | $1,929.1 |

| Total Sales Growth | 30.1 | % | (15.6) | % |

| Core Sales Growth* | 29.0 | % | (15.0) | % |

| Net Income From Continuing Operations | $263.5 | $42.5 |

| Adjusted EBITDA* | $495.0 | $251.3 |

| Cash Provided by Operating Activities | $391.4 | $283.9 |

| Free Cash Flow* | $348.3 | $241.5 |

| Diluted Earnings Per Share | $1.48 | $0.26 |

| Adjusted Diluted EPS* | $1.85 | $0.79 |

| | | | | | | | |

| $ in millions - except per share amounts | 2023 | 2022 |

| Total Revenue | $2,566.5 | $2,569.1 |

| Total Sales Growth | (0.1) | % | 2.4 | % |

| Core Sales Growth* | (0.4) | % | 4.1 | % |

| Net (Loss) Income From Continuing Operations | $(100.2) | $238.0 |

| Adjusted EBITDA* | $464.2 | $517.4 |

| Adjusted EBITDA Margin* | 18.1 | % | 20.1 | % |

| Cash Provided by Operating Activities | $275.7 | $182.7 |

| Free Cash Flow* | $223.6 | $110.3 |

| (Loss) Diluted Earnings from Continuing Operations Per Share | $(0.60) | $1.34 |

| Adjusted Diluted Earnings Per Share* | $1.53 | $1.94 |

* See Appendix A for a reconciliation of GAAP to non-GAAP measures. Core Sales Growth and Adjusted Diluted EPS as reported inAll financial metrics relate to our Financial Highlights are for continuing operations only, and do not include sales from the divested KaVo Treatment Unit and Instruments business (the “Divestiture”). Our measures under our 2021 Incentive Compensation Plan as described in further detail under “Compensation Discussion and Analysis” are consolidated and include both continuing and discontinued operations, as the Compensation Committee did not contemplate the Divestiture at the time it set the 2021 performance targets.except for cash flows measures.

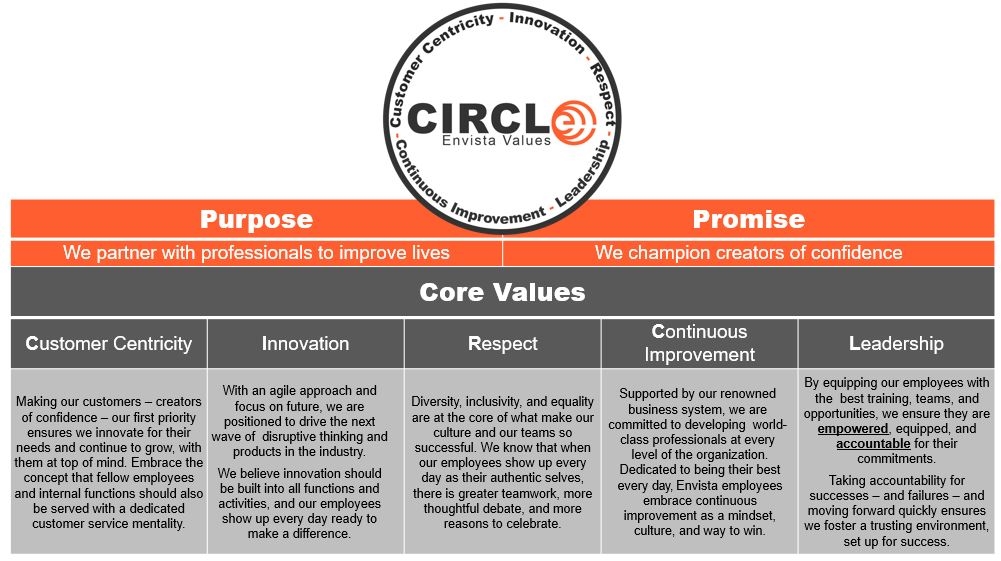

Our Values

Our core values define our company culture and guide how we operate. These core values are built around Customer centricity, leading Innovation, Respect for all, an embrace of Continuous improvement, and Leadership that is accountable for their actions and results. We use the acronym “CIRCLe” to ensure we have these values top of mind.

Human Capital Resources

Our success depends on our ability to attract, develop and retain a talented employee base. We aspire to help our employees thrive both personally and professionally. As part of these efforts, we strive to embody our core values, offer a competitive compensation and benefits program, foster aan inclusive community where everyone feels included, respected and engaged, and provide ample professional development opportunities.

Compensation and Benefits Program

Our compensation programs and practices are designed to attract employees, motivate and reward performance, drive growth and support retention. We offer competitive compensation packages based on market data, which include base salary with annual merit increases and may also include annual cash performance incentives, commissions, overtime opportunities, allowances and, in some countries where these are customary, additional monthly payments. In addition, employees in select senior management roles may receive long-term compensation in the form of equity awards. We regularly review our compensation structure to ensure that we remain competitive, reward top performance, as well as to ensure internal equity. We are pleasedpartner with independent third-party experts to conduct annual pay assessments. Our most recent pay equity review in February 2024 demonstrated that we had maintained 99% gender pay equity in the U.S. for 2021 and also confirmed that we had 99%100% race/ethnicity pay equity in the U.S. in 2021 as well. In the U.S., our benefits package includes health (medical, dental & vision) insurance, paid time off, paid parental leave, a retirement plan and life and disability coverage. In addition toOutside of the robust benefitsU.S., we offer our employees outsiderobust benefits based on local regulations and best practices of the U.S.,countries in 2021which we expanded ouroperate. Globally, we offer an Employee Assistance Program to all employees globally to support the mental health and well-being of employees and their families.

Diversity and Inclusion

Diversity, inclusion and equality are at the core of what make our culture and our teams so successful and are embodied by our value of Respect. We know that when our employees show up every day as their authentic selves, there is greater teamwork, more thoughtful debate and more reasonsOur strategy to celebrate. We are committed to a culture where diversity, respect, belonging and authenticity are valued. We drivecultivate diversity and inclusion (“D&I”) in the workplace encompasses efforts across our organization, with specific direction from executive leadership. We believe it is all of our leaders’ responsibility to ensure Envista’s D&I initiatives are appropriately aligned with our strategic business priorities. In coordination with efforts being made by wayour Human Resources professionals, we emphasize the engagement and recruitment of diverse candidate slates for executive and professional level roles and sales roles and we ensure succession plan talent is diverse in representation. We have a Diversity and Inclusion Council, consisting of leaders within the Company to drive accountability and results for our diversity and inclusion strategic efforts and initiatives. We have four standing Diversity and Inclusion Committees in the areas of talent acquisition and engagement, education and learning, events and celebrations, and global communication. We have two Employee Resource Groups: a women’s and multicultural employee resource group, as well as learning events during each historical heritage month throughout the year to celebrate our workforce. In 2021, we hosted multiple Company-wide D&I events for our employees, customers and dental students. Additionally, we have strategically partnered with the Consortium for early career diverse talent and with historically Black colleges and universities (HBCUs) and Hispanic Serving Institutions (HSIs) to further advance our workforce diversity efforts. In 2021, we provided training on Unconscious Bias to our managers and made the course available to all other employees.leadership positions across Envista.

Learning and Development Opportunities

We aim to empower our employees to thrive in their current roles, as well as to support employees’ aspirationaspirations to move into different roles. We have a promote-from-within culture with opportunities across our operating companies. We periodically assess succession planning for certain key positions and review our workforce to identify high potential employees for future growth and development. We support our employees through a multitude of training and development programs, including training on our EBS tools through our Envista Business System University, individual development plans (which encourages our employees to take charge of their learning and growth opportunities and provides access to hundreds of online courses)opportunities), job rotations, and various management trainings. We also have several programs focused on early career development, including internship programs and our six-year General Management Development Program. This commitment to our employees’ professional development reflects both our Continuous Improvement and Leadership core values.

Employee Engagement

In 2021, we launched our firstWe conduct employee engagement survey assurveys to solicit employees’ input and perspectives on our performance. In 2023, we had a standalone public company. We had an 84%92% participation rate in our inauguralthis survey, with 76% of respondents reporting feeling engaged at work and we used80% believing their managers are leading effectively. We use the feedback from the surveythese surveys to better understand whether our employees have the tools, resources, training and development opportunities to succeed. We plan to assess our employee engagement annually and futureFuture surveys will help us benchmark our progress over time and compare our results with companies in our sector. Communication is at the core of our engagement efforts and we host monthlynumerous CEO Forums for all employees, to keep our employees informed and to provide opportunities for employees globally to ask questions to senior management questions.management.

Community

Our employees have a long history of providing support and care in our communities, donating time, resources, and funds to local causes. In March 2021, we leveraged our expertise in oral health and founded the Envista Smile Project, a 501(c)(3) philanthropic foundation designed to improve the smiles and oral health of disadvantaged communities by supporting increased access to oral care and oral health education. The Envista Smile Project’s mission is to collaborate with dental professionals and Envista employee volunteers to donate products, treatment, and oral health education to communities in need around the world. The Envista Smile Project’s giving strategy focuses on three areas: mission trips, education, and monetary donations to oral health focused, non-profit organizations.

Safe Work Environment

We value the safety of our employees and have leveragedin 2023, we updated our technological resourcesbi-annual EHS Risk Assessment tool to institute work-from-home arrangements for most of our employees in response to the COVID-19 pandemic. At our manufacturing sites and office locations where employees are required to work on-site, we have implemented significant procedures to help ensure the health and safety of our workforce, that have included daily health and temperature screenings, mandatory face masks, social distancing guidelines, contact tracing, staggered shifts and frequent disinfection processes. Environmentalincrease environmental health and safety (“EHS”) results and engagement. EHS significant sites, such as manufacturing, distribution, research and development sites and large offices, are supported through a combination of on-site and remote EHS professionals. Incident reporting and investigation, auditing, and corporate oversight provide for a collaborative and transparent environment to address and minimize potential gaps.

Sustainability

From the start, establishing Envista as a company that setshas sought to set a high standard of performance on environmental, social, and governance (“ESG”) measures has been a priority.measures. Our sustainability efforts are led by our senior management and overseen by our Nominating and Governance Committee, along with our Board of Directors. We launchedreleased our Inauguralthird annual Sustainability Report in June 2021. The reportNovember 2023 (the “2022 Sustainability Report”). It is designed to provide better transparency regarding our ESG efforts, and it can be found on our public website at https://www.envistaco.com/sustainability. We encourage you to read the report2022 Sustainability Report for information regarding our ESG initiatives, including our five areas of sustainability priorities:

•Delivering Quality and Access;

•Supporting Our People and Community;

•Safeguarding the Environment;

•Centering Ethics and Compliance; and

•Practicing Good Governance.

Highlights from the report2022 Sustainability Report include:

•Putting employeeRealized a meaningful year-over-year reduction in our greenhouse gas emissions (scope 1 and customer safety first during COVID-19 by providing employees2) of 20% on an absolute basis and 22% on an intensity basis.

•Invested approximately $650,000 to support mission trips, education opportunities, and direct donations to oral health-focused non-profit organizations through the Envista Smile Project.

•Established a cross-functional Sustainability Council tasked with PPEidentifying and proper trainingacting on opportunities to continueimprove Envista's approach to operate safely during the pandemic.sustainability across our value chain.

•PrioritizingContinued to achieve both 99% gender pay equity and achieving 99% ethnic pay equity in the U.S.

•Piloting a new global supplier assessment tool to improve supplier transparencyDelivered attractive improvements in employee health and ensure compliance with all Envista policies.safety outcomes through continued investment in our EHS systems.

•Contributing to oral health by offering over 4,000 professional training and education events globally, reaching over 400,000 participants.

•Ranking among the top 6% of all Mexican facilities, Envista's Mexicali plant received Clean Industry Recertification from the Mexican government by exceeding compliance with current safety and environmental standards.

•Launching new Employee Resource Groups including – Envista Women + Friends ERG and Envista Multi-Cultural + Friends ERG.

•Expanding talent and hiring partnerships with African American student unions, Hispanic Serving Institutions and student organizations, and diverse engineering groups as well as Consortium, an organization that connects diverse MBA candidates with Envista opportunities.

•Introducing new PROPHYflex 4 Air Polishing Device high performance handpieces with improved ergonomics that allow clinicians to provide higher quality care with greater comfort and ease.

To manage the reporting process, we formed a cross-functional internal ESG steering committee consisting of senior leaders from across Envista. The ESG steering committee held meetings and reviewed sustainability frameworks, including those published by the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI) and the Task Force on Climate-related Finance Disclosures (TCFD)TCFD which helped us develop our framework for the report and identify relevant topics for disclosure and for future action. We are committed to incorporating these issues into our business operations, and to continually evaluate our sustainability issues for future reporting. We look forward to sharing our efforts and progress through subsequent Sustainability Reports.

In addition to our Sustainability Report, additional information regarding our sustainability initiatives can be found on our website at https://www.envistaco.com/sustainability.

Although we encourage our stockholders to review the information in our Sustainability Report and on our website, the contents of the report and website are not deemed filed with the SEC and are not incorporated by reference into any filing by Envista under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including this Proxy Statement.

Corporate Governance Highlights

Our Board of Directors recognizes that enhancing and protecting long-term value for our stockholders requires a robust framework of corporate governance that serves the best interests of all our stockholders.

RecentHighlights of Our Corporate Governance Actions:Framework:

•CommencedWe completed the declassification of the Board of Directors to provide for the annual election of directors. All directors after a sunset period.will be elected annually beginning with the Annual Meeting.

•EliminatedWe eliminated the supermajority voting requirements applicable to shares in our Second Amended and Restated Certificate of common stock.Incorporation.

•Implemented an ESG and sustainability program, with oversight by the Nominating and Governance Committee, and launched our Inaugural Sustainability Report.

•Conducted our annual self-assessment processto assess in detail the effectiveness of the Board and each of its committees.

Additional Highlights of Our Corporate Governance Framework:

•Our Chairperson and CEO positions are separate, with an independent Chairperson.

•All members of our Audit, Compensation, and Nominating and Governance Committees are independent as defined by the New York Stock Exchange (“NYSE”) listing standards and applicable Securities and Exchange Commission (“SEC”) rules.

•Approximately 88%Six out of our eight directors are non-employee directors and 75% of our Board is comprised of independent directors.

•Independent directors meet regularly without management.

•We hold a say-on-pay advisory vote every year.

•We have robust stock ownership requirements for our directors and executive officers.

•DirectorWe have director orientation and continuing education programs for directors.

•We have no stockholder rights plan.

•Our corporate governance guidelines limit the number of boards of other public companies on which our directors may serve to four.

•We maintain a related person transaction policy with oversight by the Nominating and Governance Committee.

•TwoAll members of the Audit Committee are audit committee financial experts.

•We maintain an ESG and sustainability program, with oversight by the Nominating and Governance Committee, and launched our third annual Sustainability Report.

•We conduct annual self-assessments to assess in detail the effectiveness of the Board, each of its committees, and our individual directors.

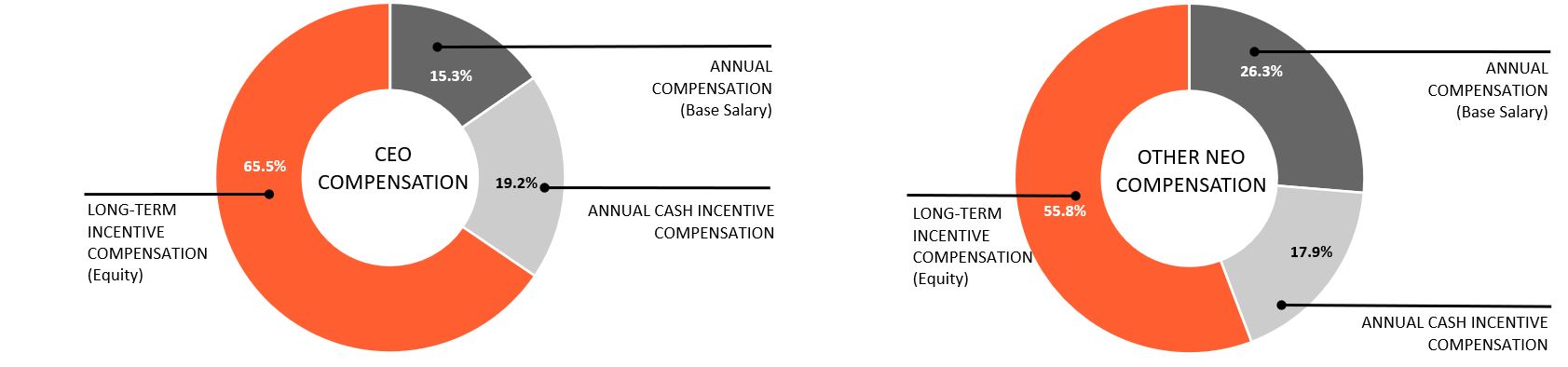

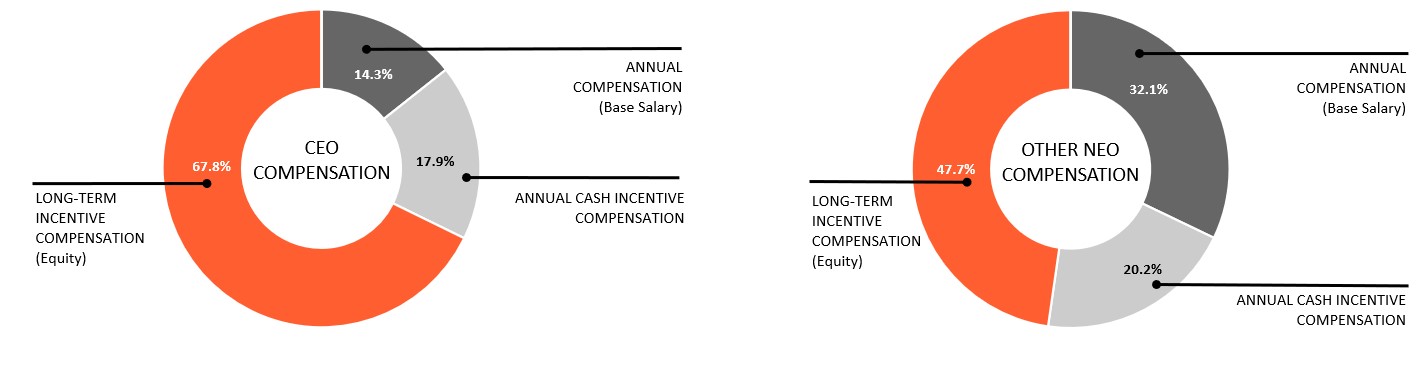

Executive Compensation Highlights

Overview of Executive Compensation Program

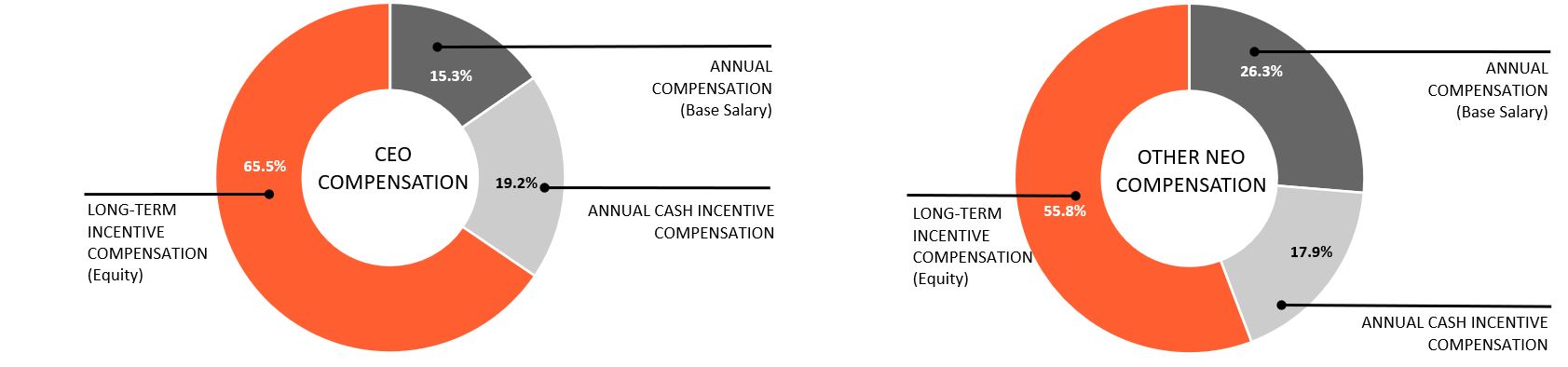

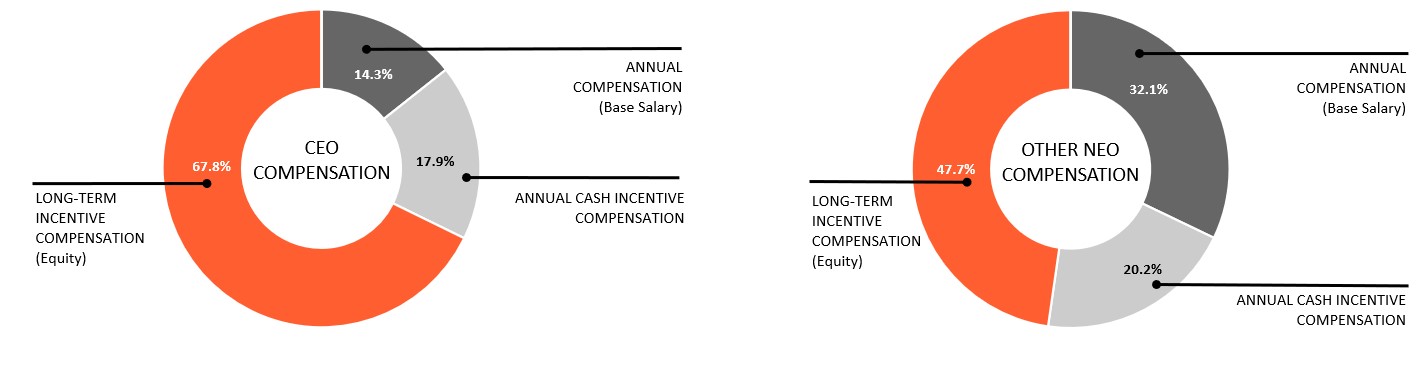

The components of our executive compensation program are intended to support our human capital strategy and to further stockholder interests as follows:

| | | | | | | | |

| ELEMENT | FORM OF COMPENSATION | PRIMARY OBJECTIVES |

| Base Salary | Cash | •Help attract and retain executive talent.

•Balance pay-at-risk components by providing a stable source of income.

•Recognize day-to-day role and scope of responsibility. |

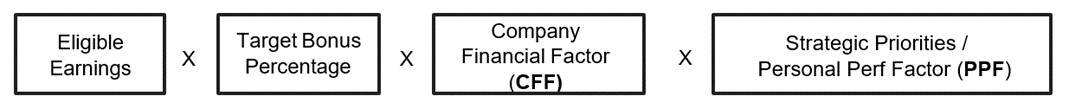

| Annual Incentive Compensation | Cash | •Align executives with key strategic and operational initiatives.

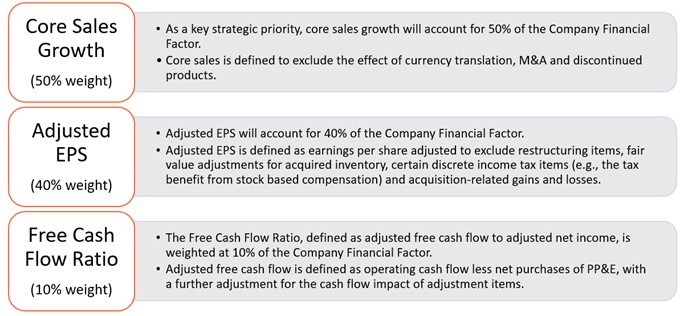

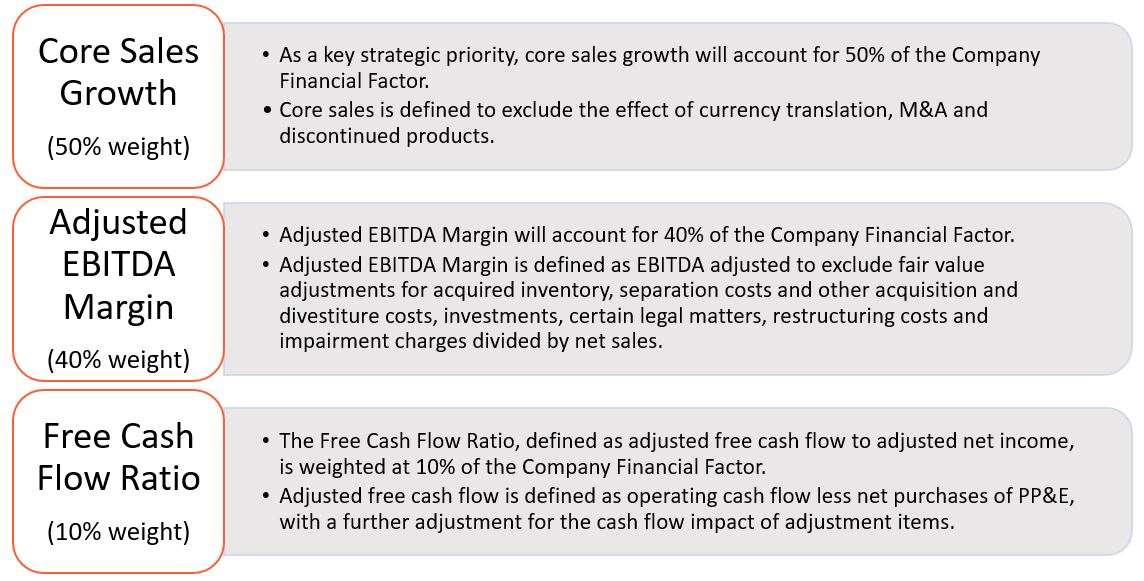

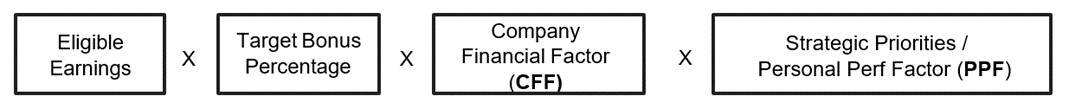

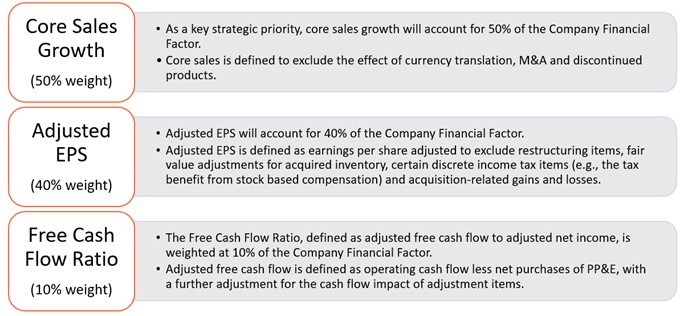

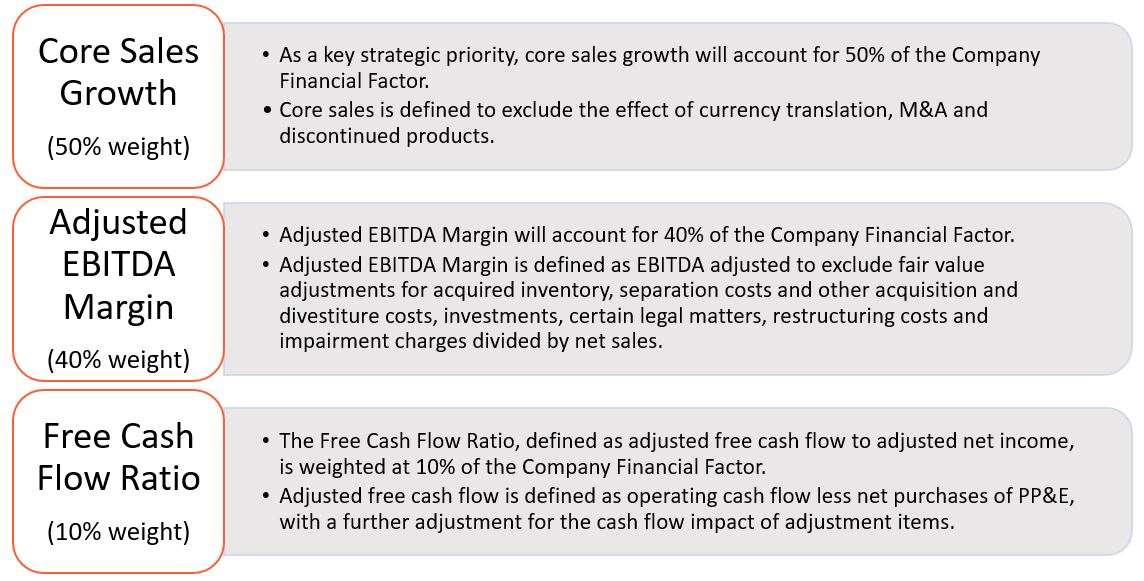

•Reward performance on key annual financial measures, including core sales growth, profitability and cashflowcash flow generation.

•Motivate and reward teamwork and individual performance. |

| Long-Term Incentive Compensation | PSUs

Stock Options

RSUs

PSUs | •Drive sustainable performance that delivers value to stockholders over the long-term.

•Provide direct alignment to stock price appreciation.

•PromotesPromote the long-term retention of our executive officers.

•Align the interest of the executive with those of the stockholders.

•PSUs reward performance on key financial measures, including core sales growth and adjusted EBITDA margin, measured over a three-year period, as modified by relative total stockholder return over a three-year period. |

| Other Compensation | Employee Benefits

Perquisites

Severance | •Provide a competitive compensation package.

•Reinforce alignment with stockholder interests through deferrals in Company stock and, also, retention through vesting restrictions.

restrictions (e.g., ECP & EDIP).

•Support corporate objectives (e.g., relocation and tax equalization benefits). |

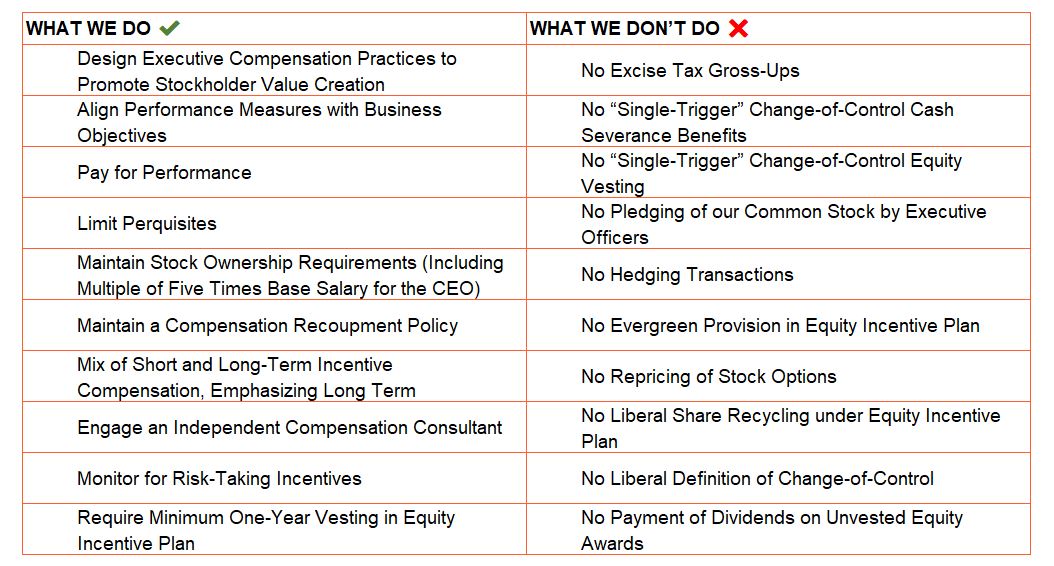

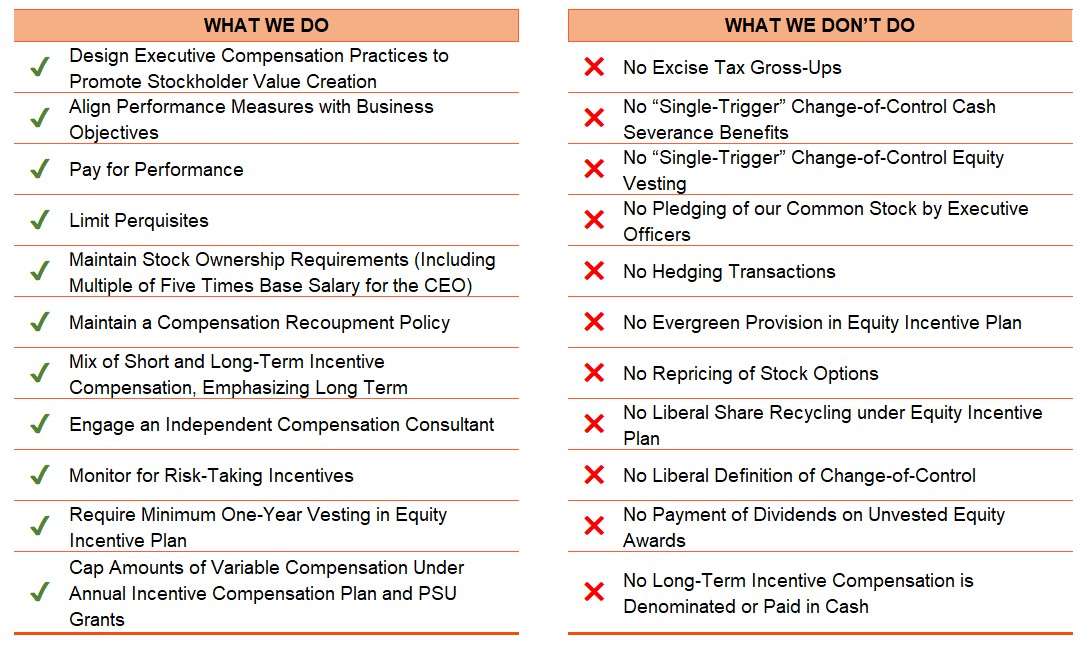

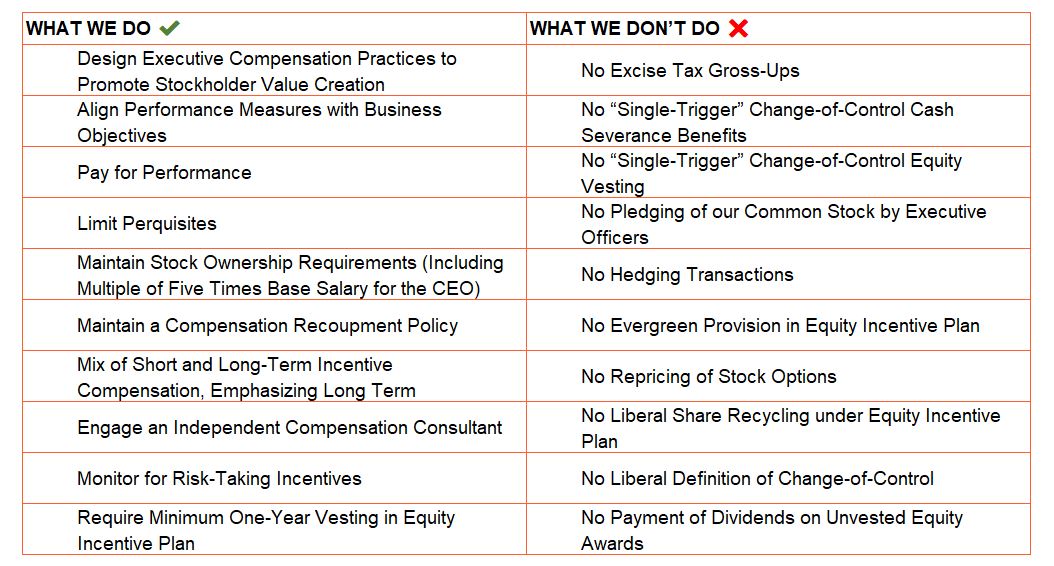

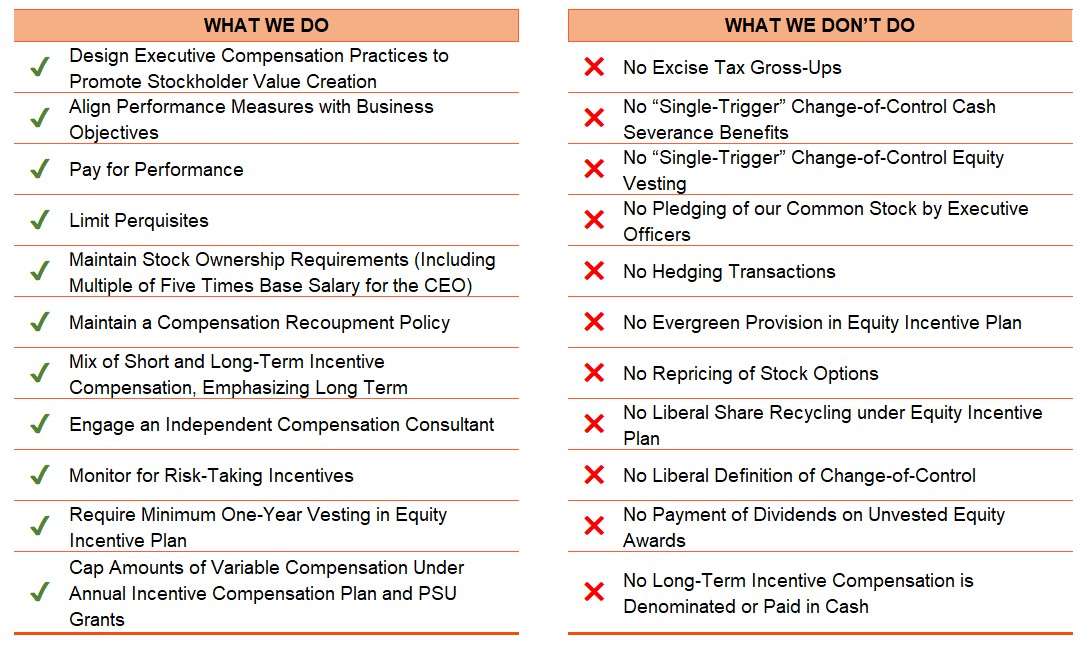

Compensation Governance Highlights

Our approach to executive compensation reflects a range of practices that promote alignment between the interests of executives and those of stockholders, as illustrated below.

Proxy Statement

Envista Holdings Corporation

200 S. Kraemer Boulevard, Building E

Brea, CA 92821

20222024 Annual Meeting of Stockholders

May 24, 202221, 2024

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (“Board”) of Envista Holdings Corporation, a Delaware corporation (“Envista”), of proxies for use at the 20222024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 7:0030 a.m., PT, and at any and all postponements or adjournments thereof. Please note that the Annual Meeting will be a virtual meeting conducted solely online and can be attended by visiting www.virtualshareholdermeeting.com/NVST2022.NVST2024. Envista’s principal address is 200 S. Kraemer Boulevard, Building E, Brea, CA 92821. The date of mailing of this Proxy Statement is on or about April 13, 2022.[ ], 2024.

Purpose of the Annual Meeting

The purpose of the Annual Meeting is to:

1.Elect the eight director nominees named in this Proxy Statement, each of Mr. Amir Aghdaei, Mr. Vivek Jain, and Mr. Daniel Raskas to serve as a Class III Director, for a one-year term expiring at the 20232025 annual meeting of stockholders and until his successor istheir successors are elected and qualified;

2.Ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022;2024;

3.Approve on an advisory basis our named executive officer compensation;

4.Approve an Amendment to our Second Amended and Restated Certificate of Incorporation to include an officer exculpation provision; and

4.5.Consider and act upon such other business as may properly come before the meeting or any adjournment thereof.

Annual Meeting Admission

If a stockholder would like to virtually attend the Annual Meeting in person, he or she must access www.virtualshareholdermeeting.com/NVST2022NVST2024 using the control number located on the Notice of Internet Availability of Proxy Materials, or on each proxy card or by following the instructions that accompanied his or her proxy materials.

Outstanding Stock and Voting Rights

In accordance with Envista’s SecondThird Amended and Restated Bylaws, the Board has fixed the close of business on March 30, 2022,25, 2024, as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting. Only stockholders of record at the close of business on that date will be entitled to vote. The only outstanding securities of Envista entitled to vote at the Annual Meeting are shares of Common Stock, $.01 par value (“Common Stock”). Each outstanding share of Common Stock entitles the holder to one vote on each directorship and other matter brought before the Annual Meeting. As of the close of business on March 30, 2022, 162,598,70325, 2024, 171,855,195 shares of Common Stock were outstanding, excluding shares held by or for the account of Envista.

Solicitation of Proxies

The proxies being solicited hereby are being solicited by the Board. The total expense of the solicitation will be borne by us, including reimbursement paid to banks, brokerage firms and nominees for their reasonable expenses in forwarding material regarding the Annual Meeting to beneficial owners. Solicitation of proxies may be made personally or by mail, telephone, internet, e-mail or facsimile by officers and other of our management employees, who will receive no additional compensation for their services. We have hired D.F. King & Co., Inc. to help us send out the proxy materials and to solicit proxies for the Annual Meeting at an estimated cost of $12,500 plus reimbursement of certain additional out of pocket expenses.

Proxy Instructions

Proxies will be voted as specified in the stockholder’s proxy.

If you sign and submit your proxy card with no further instructions, your shares will be voted:

•FOR the election of Mr. Amir Aghdaei, Mr. Vivek Jain, and Mr. Daniel Raskaseach of the eight director nominees identified in this Proxy Statement to serve as directors, each for a Class III director;one-year term expiring at the 2025 Annual Meeting;

•FOR ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022;2024;

•FOR approval of our named executive officer compensation;

•FOR approval of an Amendment to our Second Amended and Restated Certificate of Incorporation to include an officer exculpation provision; and

•In the discretion of the proxy holders on any other matter that properly comes before the meeting or any adjournment thereof. The Board has selected Amir Aghdaei and Mark Nance to act as proxies with full power of substitution.

Notice of Internet Availability of Proxy Materials

As permitted by SEC rules, we are making the proxy materials available to our stockholders primarily via the Internet. By doing so, we can reduce the printing and delivery costs and the environmental impact of the Annual Meeting. On April 13, 2022,[ ], 2024, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders. The Notice contains instructions on how to access our proxy materials and how to vote online or by telephone. If you would like to receive a paper copy of the proxy materials, please follow the instructions in the Notice.

Voting Requirements With Respect to Each of the Proposals Described in this Proxy Statement

Quorum.The quorum necessary to conduct business at the Annual Meeting consists of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting as of the record date.date present in person or represented by proxy. Virtual attendance at our Annual Meeting constitutes presence in person for purposes of quorum at the Annual Meeting. Abstentions, withhold votes, and broker non-votes will be counted as present in determining whether the quorum requirement is satisfied.

Broker Non-Votes. Under NYSE rules, if your broker holds your shares in its name and does not receive voting instructions from you, your broker has discretion to vote those shares on Proposal 2, which is considered a “routine” matter. However, on “non-routine” matters, such as Proposals 1, 3 and 3,4, your broker must receive voting instructions from you, as it does not have discretionary voting power for these particular items. Therefore, if you are a beneficial owner and do not provide your broker with voting instructions, your shares may constitute broker non-votes with respect to Proposals 1, 3 and 3.4. Broker non-votes will not affect the required vote with respect to Proposals 1 and 3.3 and will have the same effect as votes against Proposal 4.

Approval Requirements.If a quorum is present, the vote required under the Company’s SecondThird Amended and Restated Bylaws and the Second Amended and Restated Certificate of Incorporation to approve each of the proposals is as follows:

•With respect to Proposal 1, the election of directors, you may vote “for” or “withhold” authority to vote for any or all of the Class III director nominees. In elections of directors, a nominee is elected by a plurality of the votes cast by the shares entitled to vote, provided that a quorum is present. A “plurality of the votes cast” means that the individuals with the highest number of votes are elected as directors up to the maximum number of directors to be elected. Withhold votes are not considered votes cast for the foregoing purpose.

•With respect to Proposals 2 and 3, the affirmative vote of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal is required for approval. For these proposals, abstentions are counted for purposes of determining the minimum number of affirmative votes required for approval and, accordingly, have the effect of a vote against the proposal.

•With respect to Proposal 4, the affirmative vote of a majority of the outstanding shares of our common stock entitled to vote on the proposal is required for approval. Abstentions will have the same effect as votes against the proposal.

Tabulation of Votes. Broadridge Financial Solutions, Inc. will tabulate votes cast by proxy or in person (virtually) at the meeting and American Election Services, LLC will act as the Independent Inspector of Election. We will report the results in a Current Report on Form 8-K filed with the SEC within four business days of the Annual Meeting.

Voting Methods

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the registered holder of those shares. As the registered stockholder, you can ensure your shares are voted at the Annual Meeting by submitting your instructions over the Internet, or if you received printed proxy materials, via the Internet, telephone or by completing, signing, dating and returning the enclosed proxy card in the envelope provided, or by attending the virtual Annual Meeting and voting your shares at the meeting. Telephone and internet voting for registered stockholders will be available 24 hours a day, up until 11:59 p.m., Eastern time on May 23, 2022.20, 2024.

Detailed instructions for Internet voting are set forth on the Notice, proxy card or voting instruction form.

| | | | | | | | |

| 8 | | |

8 | | Vote your shares at www.proxyvote.com. |

| |

| ( | | Have your Notice of Internet Availability or proxy card in hand for the 16-digit control number needed to vote. |

| Call toll-free number 1-800-690-6903 |

| + | | Mark, sign, date, and return the enclosed proxy card or voting instruction form in the envelope we have provided or return it to:

Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

If you hold your shares through a broker, bank or nominee, rather than registered directly in your name, you are considered the beneficial owner of shares held in street name, and the proxy materials are being forwarded to you by your broker, bank or nominee, together with a voting instruction form. As the beneficial owner, you are entitled to direct the voting of your shares by your intermediary. Brokers, banks and nominees typically offer telephonic or electronic means by which the beneficial owners of shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction forms.

If you participate in the Envista Stock Fund through the Envista Holdings Corporation Savings Plan ( the(the “Savings Plan” and a “401(k) Plan”), your proxy will also serve as a voting instruction for Fidelity Management Trust Company (“Fidelity”), the trustee of the Savings Plan, with respect to shares of Common Stock attributable to your Savings Plan account as of the record date. Fidelity will vote your Savings Plan shares as of the record date in the manner directed by you. If Fidelity does not receive voting instructions from you by May 19, 2022,16, 2024, Fidelity will not vote your Savings Plan shares on any of the proposals brought at the Annual Meeting.

Changing Your Vote

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of Envista a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by virtually attending the meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or nominee and you wish to revoke your proxy or vote at the meeting, you must follow the instructions provided to you by the record holder and/or obtain from the record holder a proxy issued in your name. Virtual attendance at the meeting will not, by itself, revoke a proxy.

Householding

We are permitted to send a single setcopy of the Notice and, if applicable, our proxy statement and annual report, to stockholders who share the same last name and address. This procedure is called “householding” and is intended to reduce our printing and postage costs. We will promptly deliver a separate copy of our annual report and proxy statement to you if you contact us at Envista Holdings Corporation, Attn: Investor Relations, 200 S. Kraemer Boulevard, Building E, Brea, CA 92821; telephone us at 714-817-7000; or email us at IR@envistaco.com. In addition, if you want to receive separate copies of the proxy statement or annual report in the future; if you and another stockholder sharing an address would like to request delivery of a single copy of the proxy statement or annual report at such address in the future; or if you would like to make a permanent election to receive either printed or electronic copies of the proxy materials and annual report in the future, you may contact us at the same address, telephone number or email address. If you hold your shares through a broker or other intermediary and would like additional copies of our proxy statement or annual report or would like to request householding, please contact your broker or other intermediary.

Beneficial Ownership of Common Stock by Directors, Officers and Principal Stockholders

Directors and Executive Officers

The following table sets forth as of March 30, 202225, 2024 (unless otherwise indicated) the number of shares and percentage of Common Stock beneficially owned by each of our directors, nominees for director and each of the executive officers named in the Summary Compensation Table (the “Named Executive Officers”), and all current executive officers and directors as a group. Except as otherwise indicated and subject to community property laws where applicable, each person or entity included in the table below has sole voting and investment power with respect to the shares beneficially owned by that person or entity. Under applicable SEC rules, the definition of beneficial ownership for purposes of this table includes shares over which a person or entity has sole or shared voting or investment power, whether or not the person or entity has any economic interest in the shares, and also includes shares as to which the person has the right to acquire beneficial ownership within 60 days of March 30, 2022.25, 2024. Except as indicated, the address of each director and executive officer shown in the table below is c/o Envista Holdings Corporation, 200 S. Kraemer Boulevard, Building E, Brea, CA 92821.

| | Shares of common stock beneficially owned |

| | Shares of Common Stock beneficially owned | | | | Shares of Common Stock beneficially owned |

| Name of Beneficial Owner | Name of Beneficial Owner | | Number of Shares(1) | | Percent of Shares(1) | Name of Beneficial Owner | | Number of Shares(1) | | Percent of Shares(1) |

| Amir Aghdaei | Amir Aghdaei | | 655,531 | (2) | * | Amir Aghdaei | | 1,578,100 | (2) | * |

| Wendy Carruthers | Wendy Carruthers | | 20,215 | (3) | * | Wendy Carruthers | | 30,075 | (3) | * |

| Eric Conley | | Eric Conley | | 95,848 | (4) | * |

| Patrik Eriksson | Patrik Eriksson | | 251,063 | (4) | * | Patrik Eriksson | | 413,478 | (5) | * |

| Kieran T. Gallahue | Kieran T. Gallahue | | 14,285 | (3) | * | Kieran T. Gallahue | | 24,145 | (3) | * |

| Scott Huennekens | Scott Huennekens | | 27,425 | (3) | * | Scott Huennekens | | 40,980 | (3) | * |

| Barbara Hulit | Barbara Hulit | | 2,430 | (3) | * | Barbara Hulit | | 12,290 | (3) | * |

| Vivek Jain | Vivek Jain | | 13,220 | (3) | * | Vivek Jain | | 23,080 | (3) | * |

| Stephen Keller | | Stephen Keller | | 38,620 | (6) | * |

| Jean-Claude Kyrillos | Jean-Claude Kyrillos | | 38,502 | (5) | * | Jean-Claude Kyrillos | | — | (7) | * |

| Mark Nance | Mark Nance | | 28,665 | (6) | * | Mark Nance | | 114,870 | (8) | * |

| Daniel A. Raskas | Daniel A. Raskas | | 14,285 | (3) | * | Daniel A. Raskas | | 24,145 | (3) | * |

| Christine Tsingos | Christine Tsingos | | 20,205 | (3) | * | Christine Tsingos | | 30,065 | (3) | * |

| Howard H. Yu | Howard H. Yu | | 71,706 | (7) | * | Howard H. Yu | | 5,871 | (9) | * |

| All directors and executive officers as a Group (13 persons) | | 1,236,852 | (8) | * |

| All current directors and executive officers as a group (13 persons) | | All current directors and executive officers as a group (13 persons) | | 2,194,689 | (10) | 1.3% |

_________________

* Denotes less than 1% of the outstanding Common Stock on March 30, 202225, 2024

(1)Balances credited to each executive officer’s account under the Envista Executive Deferred Incentive Plan (the “EDIP”), the Envista Excess Contribution Program (the “ECP”) and/or the Envista Deferred Contribution Plan (the “DCP”) which are vested or are scheduled to vest within 60 days of March 30, 2022,25, 2024, are included in the table. See “Employee Benefit Plans—Supplemental Retirement Program” for a description of our EDIP, ECP and DCP. The incremental number of notional phantom shares of Common Stock credited to a person’s EDIP, ECP, or DCP account is based on the incremental amount of contribution to the person’s EDIP, ECP, or DCP balance divided by the closing price of Common Stock as reported on the NYSE on the date of the contribution. The table also includes shares that may be acquired upon exercise of options that are exercisable within 60 days of March 30, 202225, 2024 or upon vesting of Restricted Stock Units (“RSUs”) that vest within 60 days of March 30, 2022.25, 2024.

(2)Includes 35,128184,649 shares of Common Stock held by Mr. Aghdaei, 10,000 shares acquired through our directed share program in connection with the IPO, options to acquire 503,0211,307,151 shares, 37,250 RSUs that vested on February 24, 2021 but are not available to Mr. Aghdaei until February 24, 2023, and 70,13286,300 shares attributable to Mr. Aghdaei’s EDIP account.

(3)Consists of RSUs that are vested but not released and RSUs granted to non-employee directors which vest within 60 days of March 30, 2022. The25, 2024. For grants before 2022, the underlying shares of vested RSUs will be delivered at the earlier of the director’s death or the first day of the seventh month following the director’s resignation from the Board. RSUs granted in 2022 and after will vest on the first anniversary of the date of grant, unless a compliant Section 409A deferral election is made by the participant. Ms. Tsingos’ total also includes 4,435 shares of Common Stock, Ms. Carruthers’ total also includes 10 shares of Common Stock and Ms. Hulit’s total also includes 5 shares of Common Stock.

(4)Includes 33,01219,989 shares of Common Stock held by Mr. Conley, options to acquire 59,312 shares, 2,636 RSUs and 10,424 stock options that vest within 60 days of March 25, 2024 and 3,487 shares attributable to Mr. Conley’s DCP and ECP account.

(5)Includes 62,017 shares of Common Stock held by Mr. Eriksson, 5,000 shares acquired through our directed share program in connection with the IPO, options to acquire 181,351305,318 shares, 4,0454,044 shares under Mr. Eriksson’s 401(k) account, and 27,65542,099 shares attributable to Mr. Eriksson’s EDIP account. Mr. Eriksson ceased serving as SVP and President, Nobel Biocare, effective December 31, 2023.

(5)(6)Includes 5,5806,806 shares of Common Stock held by Mr. Kyrillos,Keller, options to acquire 32,81430,603 shares, and 1081,211 shares attributable to Mr. Kyrillos’Keller’s’ DCP and ECP account.

(6)(7)Mr. Kyrillos ceased serving as SVP and President, Diagnostics and Digital Solutions, effective June 30, 2023 and holds no shares of Common Stock.

(8)Includes 7,80426,662 shares of Common Stock held by Mr. Nance, options to acquire 19,89485,090 shares, and 9673,118 shares attributable to Mr. Nance’s DCP and ECP account.

(7)(9)Includes 5,3412,000 shares of Common Stock held by Mr. Yu 2,000 shares acquired through our directed share program in connection with the IPO, options to acquire 62,934 shares, and 1,4313,871 shares attributable to Mr. Yu’s DCP and ECP account. Mr. Yu ceased serving as Chief Financial Officer effective September 22, 2023.

(10)Includes 89,115261,190 shares of Common Stock, 18,000 shares acquired through our directed share program in connection with the IPO, options to acquire 865,1441,629,693 shares, 121,320140,155 RSUs that have vested but are not released until a later date, 28,29242,811 RSUs that will vest within 60 days of March 30, 2022, 1,12925, 2024, 10,424 options that will vest within 60 days of March 30, 2022, 4,045 shares attributable to 401(k) accounts, 107,30125, 2024, 102,600 shares attributable to EDIP accounts, and 2,5067,816 shares attributable to DCP and ECP accounts.

Principal Stockholders

The following table sets forth the number of shares and percentage of Common Stock beneficially owned by each person who owns of record or is known to us to beneficially own more than five percent of our Common Stock. | | | | | | | | | | | | | | | | | | | | |

| NAME AND ADDRESS | | NUMBER OF SHARES

BENEFICIALLY OWNED | | | | PERCENT

OF CLASS |

FMR LLC

245 Summer Street, Boston, MA 02210 | | 24,287,159 | | (1) | | 15.0% |

BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 | | 16,764,701 | | (2) | | 10.4% |

The Vanguard Group

100 Vanguard Blvd., Malvern, PA 19355 | | 14,952,817 | | (3) | | 9.3% |

Morgan Stanley

1585 Broadway, New York, NY 10036 | | 13,799,776 | | (4) | | 8.6% |

| | | | | | | | | | | | | | | | | | | | |

| NAME AND ADDRESS | | NUMBER OF SHARES

BENEFICIALLY OWNED | | | | PERCENT

OF CLASS |

BlackRock, Inc. 50 Hudson Yards, New York, NY 10001 | | 18,278,869 | | (1) | | 10.7% |

The Vanguard Group

100 Vanguard Blvd., Malvern, PA 19355 | | 17,167,767 | | (2) | | 10.0% |

Morgan Stanley

1585 Broadway, New York, NY 10036 | | 15,898,867 | | (3) | | 9.3% |

Harris Associates L.P.

111 South Wacker Drive, Suite 4600, Chicago, IL 60606 | | 11,078,748 | | (4) | | 6.5% |

(1)The amount shown and the following information is derived from a Schedule 13G/A filed January 24, 2024 by BlackRock, Inc., which sets forth its beneficial ownership as of December 31, 2023. According to the Schedule 13G/A, BlackRock Inc. has sole voting power over 17,656,053 shares and sole dispositive power over 18,278,869 shares.

(2)The amount shown and the following information is derived from a Schedule 13G/A filed January 10, 2024 by The Vanguard Group, which sets forth its beneficial ownership as of December 31, 2023. According to the Schedule 13G/A, The Vanguard Group has shared voting power over 59,950 shares, sole dispositive power over 16,929,398 shares and shared dispositive power over 238,369 shares.

(3)The amount shown and the following information is derived from a Schedule 13G/A filed February 9, 2022 by FMR LLC and Abigail P. Johnson, which sets forth their respective beneficial ownership as of December 31, 2021. According to the Schedule 13G/A, FMR LLC and Abigail P. Johnson have sole voting power over 2,339,277 shares and sole dispositive power over 24,287,159 shares.

(2)The amount shown and the following information is derived from a Schedule 13G/A filed January 27, 2022 by BlackRock, Inc., which sets forth its beneficial ownership as of December 31, 2021. According to the Schedule 13G/A, BlackRock Inc. has sole voting power over 16,242,252 shares and sole dispositive power over 16,764,701 shares.

(3)The amount shown and the following information is derived from a Schedule 13G/A filed February 10, 2022 by The Vanguard Group, which sets forth its beneficial ownership as of December 31, 2021. According to the Schedule 13G/A, The Vanguard Group has shared voting power over 77,229 shares, sole dispositive power over 14,730,511 shares and shared dispositive power over 222,306 shares.

(4)The amount shown and the following information is derived from a Schedule 13G/A filed February 10, 20228, 2024 jointly by Morgan Stanley, BostonAtlanta Capital Management and Research,Company, LLC (“Atlanta Capital”), and Eaton Vance Atlanta Capital SMID-Cap Fund (“Eaton Vance”), which sets forth their respective beneficial ownership as of December 31, 2021.2023. According to the Schedule 13G/A, Morgan Stanley has shared voting power over 13,539,21715,379,869 shares and shared dispositive power over 13,799,77615,839,532 shares, Boston Management and ResearchAtlanta Capital has shared voting power over 12,111,948 shares and shared dispositive power over 9,107,50912,432,136 shares, and Eaton Vance has shared voting and dispositive power over 8,918,0219,678,610 shares.

(4)The amount shown and the following information is derived from a Schedule 13G filed February 14, 2024 by Harris Associates L.P. and Harris Associates Inc., which sets forth their respective beneficial ownership as of December 31, 2023. According to the Schedule 13G, Harris Associates L.P. and Harris Associates Inc. have sole voting power over 5,611,676 shares and sole dispositive power over 11,078,748 shares.

Proposal 1. Election of Directors

Declassification of the Board

Pursuant to the Company’s Second Amended and Restated Certificate of Incorporation, the Board is constituted into three classes as follows:

•Class I: Kieran T. Gallahue and Barbara Hulit, whose terms expire at the 2023 Annual Meeting of Stockholders;

•Class II: Wendy Carruthers, Scott Huennekens, and Christine Tsingos, whose terms expire at the 2024 Annual Meeting of Stockholders; and

•Class III: Amir Aghdaei, Daniel A. Raskas, and Vivek Jain, whose terms expire at the Annual Meeting.

At the 2021 Annual Meeting of Stockholders, the stockholders approved a proposal from our Board to amend our Certificate of Incorporation to declassify the Board and to provide, starting with the Annual Meeting, for the election of directors to one-year terms. As a result, our Board will be declassified in the following manner:

•The Class III directors elected at the Annual Meeting (and at each annual meeting thereafter) will serve one-year terms.

•Beginning with the 2023 Annual Meeting of Stockholders, a majority of the directors will be elected annually.

•Beginning with the 2024 Annual Meeting of Stockholders, the entire Board will be elected annually.

Election of Directors

As of the Annual Meeting, our Board is fully declassified and all directors are elected annually. At the Annual Meeting, stockholders will be asked to elect each of the current Class III director nominees identified belowAmir Aghdaei, Wendy Carruthers, Kieran Gallahue, Scott Huennekens, Barbara Hulit, Vivek Jain, Daniel Raskas, and Christine Tsingos (who have been recommended by the Nominating and Governance Committee, nominated by the Board and currently serve as Class III Directorsdirectors of Envista) to serve until the 20232025 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified.

We have set forth below information as of March 30, 202225, 2024 relating to each nominee for election as director, and each director continuing in office, including: his or her principal occupation and any board memberships at other public companies during the past five years; the other experience, qualifications, attributes or skills that led the Board to conclude that he or she should continue to serve as a director of Envista; the year in which he or she became a director; and age. Please see “Corporate Governance – Director Nomination Process” for a further discussion of the Board’s process for nominating Board candidates. Each of the nominees has consented to serve if elected. In the event a nominee declines or is unable to serve, the proxies may be voted in the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

Class IIIDirector Nominees – One-Year Term That Will Expire in 2023

| | | | | | | | | | | | | | |

|

| | |

Amir

Aghdaei | | Director since: 2019 | | Other Current Public Company Directorships: None |

Age: 64 66 | | | | Board Committees: None |

Amir Aghdaei has served as our President and Chief Executive Officer and as a director on our Board since May 2019. Prior to that, Mr. Aghdaei served in multiple leadership roles since joining Danaher Corporation in 2008, including as Vice President - Group Executive since 2011 and with responsibility for Danaher’s Dental business since July 2015. Before joining Danaher, Mr. Aghdaei served in a variety of international leadership roles with Hewlett-Packard Company, Agilent Technologies Inc. and Credence Systems Corporation. Mr. Aghdaei brings to Envista an in-depth knowledge of our Dental business and extensive international experience, which is particularly important given our global footprint.

Qualifications: Mr. Aghdaei’s qualifications to sit on the Board include, among other factors, his extensive experience in senior leadership positions, his in-depth knowledge of our Company as our CEO since our IPO and from his prior experience at Danaher, and his international experience.

| | | | | | | | | | | | | | |

|

| | |

Daniel A.

RaskasWendy Carruthers | | Director since: 2019

| | Other Current Public Company Directorships: None |

Age: 55 | | Independent | | Board Committees: NoneCommittees: Compensation (Chair) & Nominating and Governance |

Daniel A. RaskasWendy Carruthers has served as Executive Vice President of Human Resources at Boston Scientific Corporation, a medical device manufacturer, since February 2022 and as Senior Vice President - Corporate Development of Danaher Corporation since 2010Human Resources from December 2012 until February 2022 after serving in a series of progressively more responsible human resources roles since joining Boston Scientific in 2004, including as Vice President - Corporate Developmentof Human Resources for Europe, Middle East and Africa from 2004, when he joined Danaher. PriorJanuary 2006 to joining Danaher, Mr. Raskas was a Managing Director for Thayer Capital Partners, a private equity investment firm. Mr. Raskas’ corporate development and private equity experience give him particular insight into acquisition strategy, which represents a key strategic opportunity for us.December 2010.

Qualifications: Mr. Raskas’Ms. Carruthers’ qualifications to sit on the Board include, among other factors, his corporate developmentan international business background and M&A expertise.broad experience in the areas of executive compensation and talent management.

| | | | | | | | | | | | | | |

| | | | |

| | |

Vivek JainKieran T. Gallahue | | Director since: 2020

2019

| | Other Current Public Company Directorships: Edwards Lifesciences |

Age: 60 | | Independent | | Board Committees: Nominating and Governance (Chair) |

Kieran T. Gallahue is the former Chairman and Chief Executive Officer of CareFusion Corporation, a global medical technology company, from 2011 until its acquisition by Becton, Dickinson and Company in March 2015. From January 2008 through January 2011, Mr. Gallahue served as President, Chief Executive Officer and a Director of ResMed, Inc., a medical device firm serving the sleep-disordered breathing and respiratory markets. Mr. Gallahue is also currently a member of the Board of Directors of Edwards Lifesciences Corp. and previously served as a director of Intersect ENT, Inc. and Arena Pharmaceuticals, Inc.

Qualifications: Mr. Gallahue’s qualifications to sit on the Board include, among other factors, prior Chairman and CEO experience, extensive public company board experience and a deep knowledge of the medical device industry and related fields.

| | | | | | | | | | | | | | |

|

| | |

| Scott Huennekens | | Director since: 2019 | | Other Current Public Company Directorships: Hyperfine, Inc.

|

Age: 59 | | Independent | | Board Committees: Audit & Nominating and Governance |

Scott Huennekens served as President, Chief Executive Officer and Chairman of the Board of Directors of Verb Surgical, Inc., a medical equipment manufacturer, from August 2015 to January 2019. Prior to this role, Mr. Huennekens served as President and Chief Executive Officer of Volcano Corporation, a medical device company, from 2002 to February 2015, and as President and Chief Executive Officer of Digirad Corporation, a diagnostic imaging centers company, from 1999 to 2002. Mr. Huennekens is currently a member of the Board of Directors of Hyperfine, Inc., and previously served as a director of NuVasive, Inc., Acutus Medical, Inc., ViewRay, Inc., Reva Medical Inc., EndoChoice Holdings, Volcano Corporation and Bellerophon Therapeutics Inc.

Qualifications: Mr. Huennekens’ qualifications to sit on the Board include, among other factors, prior public company Chairman and CEO experience and an extensive background in the medical device field.

| | | | | | | | | | | | | | |

| | | | |

| | |

| Barbara Hulit | | Director since: 2021 | | Other Current Public Company Directorships: Novanta Inc. and PACCAR Inc. |

Age: 57 | | | | Board Committees: None |

Barbara Hulit served as President and Chief Executive Officer of the Advanced Healthcare Solutions segment of Fortive Corporation, a global technology company and former affiliate of the Company, from July 2021 until her retirement in April 2022 and Senior Vice President from June 2016 to July 2021. She was also a co-executive sponsor of the Allies Across Fortive employee and friends resource group. As a founding SVP at Fortive in 2016, Ms. Hulit had company-wide responsibility for the Fortive Business System (FBS), as well as procurement, IT, high-growth markets, and innovation, building on her experience running the Danaher Business System Office for 3 years. She previously spent nearly 8 years as president and group executive of Fluke, served as a partner at The Boston Consulting Group, and held sales and marketing roles at Noxell, PepsiCo, and Marketing Corporation of America. Ms. Hulit was named one of the top women in STEM for her role in establishing Washington STEM, and she serves on the Dean’s Advisory Council for the Kellogg Graduate School of Management. Ms. Hulit is also currently a member of the Board of Directors of Novanta Inc. and PACCAR Inc.

Qualifications: Ms. Hulit’s qualifications to sit on the Board include, among other factors, her executive leadership and extensive operational experience, as well as in-depth knowledge of the Danaher Business System, which gives her invaluable insight into EBS and our core value of continuous improvement.

| | | | | | | | | | | | | | |

|

| | |

| Vivek Jain | | Director since: 2020

| | Other Current Public Company Directorships: ICU Medical, Inc. |

Age: 50 52 | | Independent | | Board Committees: Audit & Finance |

Vivek Jain has served as CEO and Chairman of the Board of ICU Medical, Inc., a global medical technology company specializing in infusion therapy, since February 2014. Prior to this role, Mr. Jain served at CareFusion Corporation, a global medical technology company, as President of Procedural Solutions from 2011 to February 2014 and as President, Medical Technologies and Services from September 2009 until 2011. Before joining CareFusion Corporation, Mr. Jain served as the Executive Vice President-Strategy and Corporate Development of Cardinal Health, Inc., a health care services company, from June 2007 until August 2009. Mr. Jain served as Senior Vice President, Business Development and M&A for the Philips Medical Systems business of Koninklijke Philips Electronics N.V., an electronics company, from 2006 to August 2007. Mr. Jain served as an investment banker at J.P. Morgan Securities, Inc., an investment banking firm, from 1994 to 2006. Mr. Jain’s last position with J.P. Morgan was as Co-Head of Global Healthcare Investment Banking from 2002 to 2006. Mr. Jain brings to Envista significant CEO and Chairman experience at a public company and a deep background in the medical technology and healthcare fields, which are areas of particular value to our Board.

Qualifications: Mr. Jain’s qualifications to sit on the Board include, among other factors, prior public company Chairman and CEO experience and an extensive background in medical technology and healthcare.

| | | | | | | | | | | | | | |

| | |

Daniel A.

Raskas | | The Board of Directors recommends that stockholders vote “FOR” the election toDirector since: 2019

the Board of each of the foregoing Class III Director Nominees.

|

Current Class I Directors – Directors with Terms That Will Expire in 2023

| | | | | | | | | | | | | | |

| | | | |

| | |

Kieran T. Gallahue | | Director since: 2019

| | Other Current Public Company Directorships: Edwards Lifesciences and Intersect ENT None |

Age: 58 57 | | Independent | | Board Committees: Nominating and Governance (Chair) and Compensation & Finance |

Kieran T. Gallahue is the former Chairman and Chief Executive Officer of CareFusion Corporation, a global medical technology company, from 2011 until its acquisition by Becton, Dickinson and Company in March 2015. From January 2008 through January 2011, Mr. Gallahue

Daniel A. Raskas has served as Senior Vice President Chief Executive Officer and- Corporate Development of Danaher Corporation (“Danaher”) since 2010 after serving as Vice President - Corporate Development from 2004, when he joined Danaher. Prior to joining Danaher, Mr. Raskas was a Managing Director of ResMed, Inc.,for Thayer Capital Partners, a medical device firm serving the sleep-disordered breathing and respiratory markets. private equity investment firm.

Qualifications: Mr. Gallahue is also currently a member ofRaskas’ qualifications to sit on the Board of Directors of each of Edwards Lifesciences Corp.include, among other factors, his corporate development and Intersect ENT, Inc. Mr. Gallahue brings to Envista extensive executive leadership and public company boardprivate equity experience as well aswhich give him particular insight into acquisition strategy, which represents a deep background in the medical device industry and other related fields, all of which are particularly valuable attributes to our Board.key strategic opportunity for us.

| | | | | | | | | | | | | | |

| | | | |

| | |

Barbara HulitChristine Tsingos | | Director since: 2021 2019 | | Other Current Public Company Directorships: None |

Age: 55

| | Independent | | Board Committees: Audit |

Barbara Hulit is Senior Vice President of Fortive Corporation and President and Chief Executive Officer of Fortive’s Advanced Healthcare Solutions segment. Ms. Hulit provides executive leadership for the Europe, Middle East, and Africa (EMEA) business as well as The Fort, Fortive’s hub for innovation, data analytics, and machine learning. She is also a co-executive sponsor of the Allies Across Fortive employee and friends resource group. As a founding SVP at Fortive in 2016, Ms. Hulit had company-wide responsibility for the Fortive Business System (FBS) as well as procurement, IT, high-growth markets, and innovation, building on her experience running the Danaher Business System Office for 3 years. She previously spent nearly 8 years as president and group executive of Fluke, served as a partner at The Boston Consulting Group, and held sales and marketing roles at Noxell, PepsiCo, and Marketing Corporation of America. Ms. Hulit was named one of the top women in STEM for her role in establishing Washington STEM, and she serves on the Dean’s Advisory Council for the Kellogg Graduate School of Management. Ms. Hulit brings to Envista executive leadership and extensive operational experience, as well as deep knowledge of the Danaher Business System, which gives her invaluable insight into EBS and our core value of continuous improvement.

Current Class II Directors – Directors with Terms That Will Expire in 2024

| | | | | | | | | | | | | | |

|

| | |

Wendy Carruthers | | Director since: 2019

| | Other Current Public Company Directorships: None

|

Age: 53

| | Independent | | Board Committees: Compensation (Chair) & Nominating and Governance

|

Wendy Carruthers has served as Executive Vice President of Human Resources at Boston Scientific Corporation, a medical device manufacturer, since February 2022 and as Senior Vice President of Human Resources from December 2012 until February 2022 after serving in a series of progressively more responsible human resources roles since joining Boston Scientific in 2004, including as Vice President of Human Resources for Europe, Middle East and Africa from January 2006 to December 2010. A native of the United Kingdom, Ms. Carruthers’ international background and broad experience in the areas of executive compensation and talent management are particularly valuable to our Board as international expansion and talent acquisition, development, compensation and retention are critical strategic objectives for Envista.

| | | | | | | | | | | | | | |

|

| | |

Scott Huennekens | | Director since: 2019

| | Other Current Public Company Directorships: NuVasive, Inc., Hyperfine, Inc. and Acutus Medical, Inc.

|

Age: 57

| | Independent | | Board Committees: Nominating and Governance

|

Scott Huennekens served as President, Chief Executive Officer and Chairman of the Board of Directors of Verb Surgical, Inc., a medical equipment manufacturer, from August 2015 to January 2019. Prior to this role, Mr. Huennekens served as President and Chief Executive Officer of Volcano Corporation, a medical device company, from 2002 to February 2015, and as President and Chief Executive Officer of Digirad Corporation, a diagnostic imaging centers company, from 1999 to 2002. Mr. Huennekens is currently a member of the Board of Directors of NuVasive, Inc., Hyperfine, Inc. and Acutus Medical, Inc., and previously served as a director of ViewRay, Inc., Reva Medical Inc., EndoChoice Holdings, Volcano Corporation and Bellerophon Therapeutics Inc. Mr. Huennekens brings to Envista an extensive background in the medical device field and significant tenure leading public companies as both Chairman and CEO, which positions him to provide to us strategic market insights as well as deep leadership experience.

| | | | | | | | | | | | | | |

|

| | |

Christine Tsingos | | Director since: 2019

| | Other Current Public Company Directorships: Onto Innovation Inc., Varex Imaging Corporation and Codex DNA,Telesis Bio Inc.

|

Age: 63 65 | | Independent | | Board Committees: Audit (Chair), Compensation & CompensationFinance |

Christine Tsingos served as Executive Vice President and Chief Financial Officer at Bio-Rad Laboratories, Inc., a manufacturer of life science research and clinical diagnostics products, from 2002 to May 2019. Ms. Tsingos is also currently a member of the Board of Directors of each of Onto Innovation Inc. (formerly Nanometrics Incorporated), Varex Imaging Corporation and Telesis Bio Inc. (formerly Codex DNA, Inc. Inc).

Qualifications: Ms. Tsingos bringsTsingos’ qualifications to Envistasit on the Board include, among other factors, deep finance and accounting leadership as well as substantial audit committee experience, which are areas of critical importance for us as a large, global and complex public company.experience.

| | | | | | | | | | | |

The Board of Directors recommends that stockholders vote “FOR” the election to the Board of each of the foregoing Director Nominees. |

Board Composition and Diversity

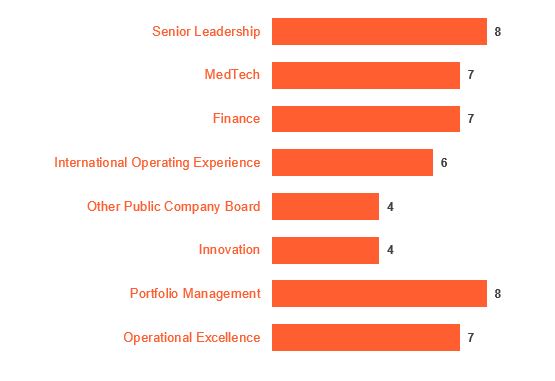

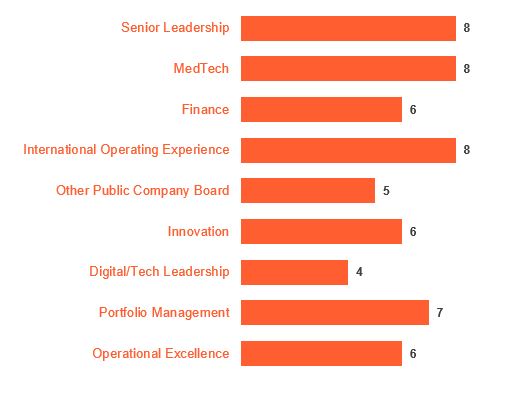

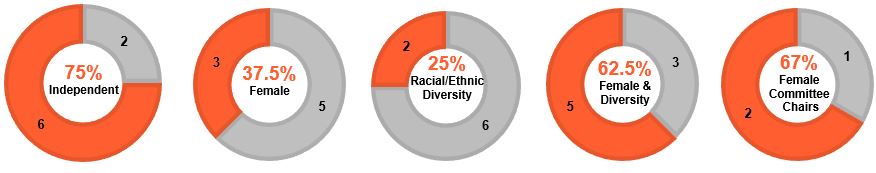

The below charts reflect information for all director nominees and continuing directors (8 directors). The Skills and Experience graph reflects the number of directors with substantial experience in each of the listed categories.

Skills and Experience

Independence and Diversity

Corporate Governance

Corporate Governance Overview

Our Board of Directors recognizes that enhancing and protecting long-term value for our stockholders requires a robust framework of corporate governance that serves the best interests of all our stockholders.

Recent Governance Actions:

•Commenced declassification of the Board of Directors to provide for the annual election of directors after a sunset period.

•Eliminated the supermajority voting requirements applicable to shares of common stock.

•Implemented an ESG and sustainability program, with oversight by the Nominating and Governance Committee, and launched our Inaugural Sustainability Report.

•Conducted our annual self-assessment processto assess in detail the effectiveness of the Board and each of its committees.

Additional Highlights of Our Corporate Governance Framework:

•We completed the declassification of our Board of Directors to provide for the annual election of directors. All directors will be elected annually beginning with the Annual Meeting.

•We eliminated the supermajority voting requirements in our Second Amended and Restated Certificate of Incorporation.

•Our Chairperson and CEO positions are separate, with an independent Chairperson.

•All members of our Audit, Compensation, and Nominating and Governance Committees are independent as defined by the NYSE listing standards and applicable SEC rules.

•Approximately 88%Six out of our eight directors are non-employee directors and 75% of our Board is comprised of independent directors.

•Independent directors meet regularly without management.

•We hold a say-on-pay advisory vote every year.

•We have robust stock ownership requirements for our directors and executive officers.

•DirectorWe have director orientation and continuing education programs for directors.